In today’s fast-paced world, financial emergencies can strike at any moment, leaving us in dire need of quick cash. Fortunately, technology has revolutionized the lending industry, making it easier and faster to access loans. Among the various loan apps available, one stood out for me – the “JuanHand Cash Loan App.” In this, I will share my personal experience with this app, step-by-step usage highlighting its key features and the low processing fee, making it an ideal choice for anyone seeking instant financial assistance.

JuanHand is one of the leading fintech platforms in the Philippines providing quick, seamless, affordable financial access to the credit worthy yet underserved. Anybody through the JuanHand App can borrow money for up to PHP25,000 quickly and efficiently regardless of your credit history. This is very convenient to Filipinos especially those who just need a micro loan for their small business or emergencies.

How to get a quick loan from the JuanHnd App?

I. Registration and loan application

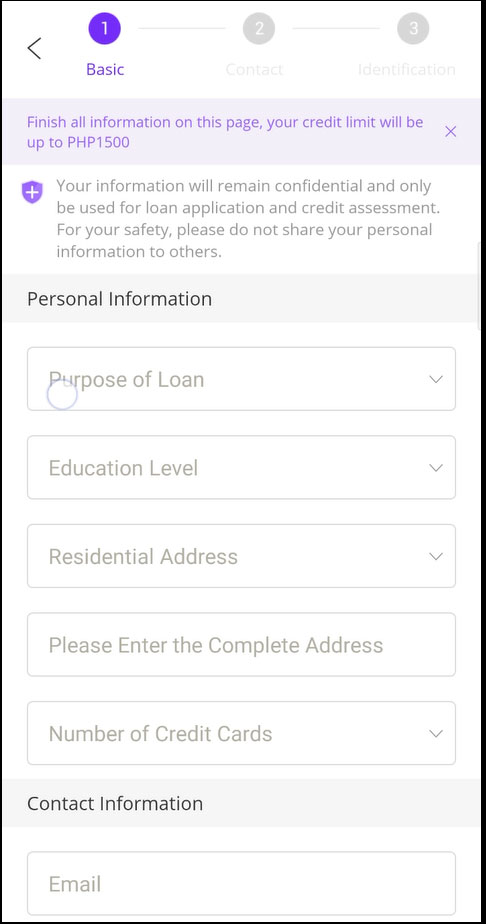

You will need to provide accurate information truthful information about yourself to start the process of your application. Here are the steps:

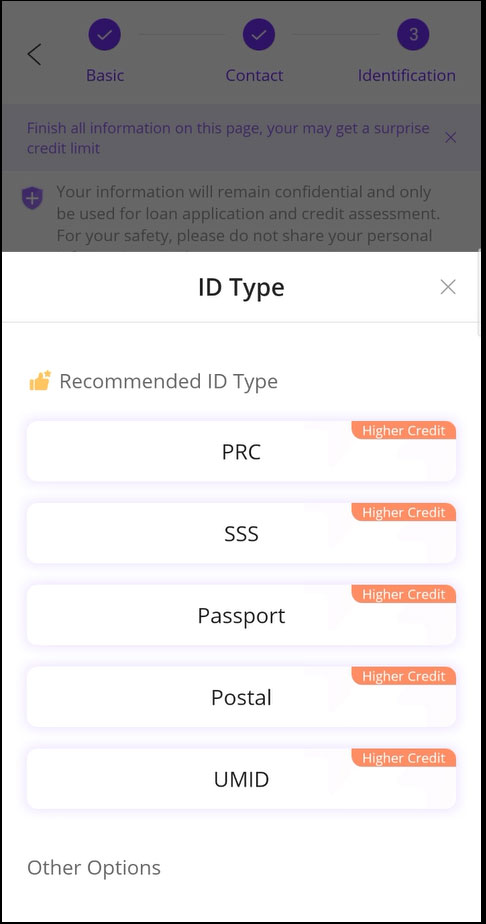

1.) First you will need to download the JuanHand App on your phone. You will need to prepare one valid ID as proof of your identity. You can prepare any of these ID’s:

- UMID (Unified Multi-purpose ID)

- Driver’s License

- Passport

- Voter’s ID (Digitized, with QR code)

- Postal ID

- Social Security System (SSS) ID

- Philsys ID

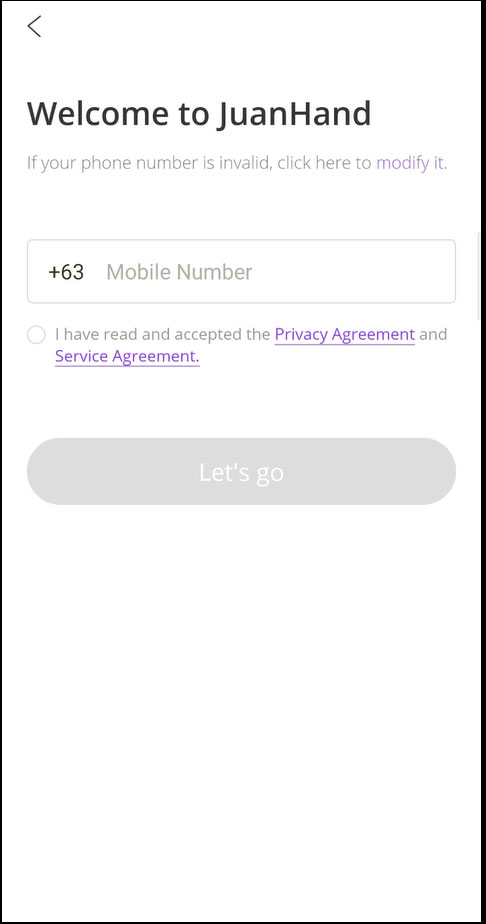

2.) Next is you will need to register an account through the JuanHand App. Provide your valid and working mobile number to start the registration. You will be receiving a verification code via SMS with the mobile number you’ll be using.

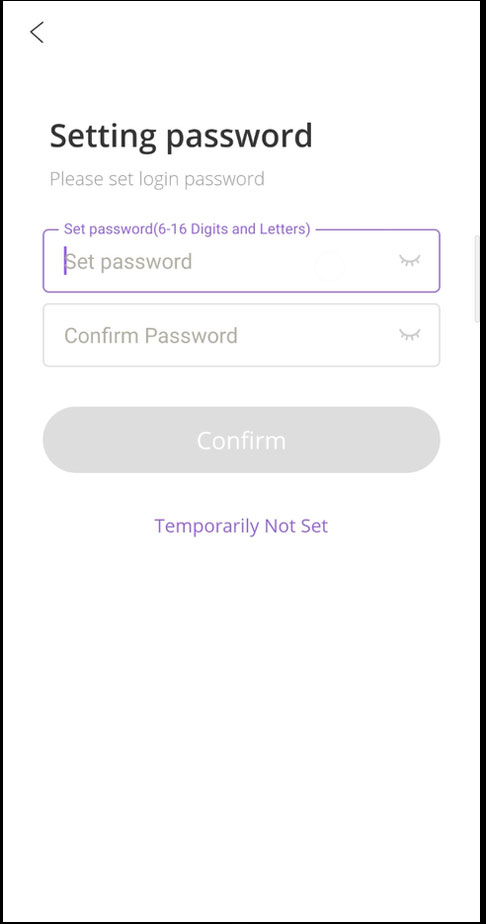

Create a password and make sure it’s a strong one. It will be the password you’ll be using to access the app anytime.

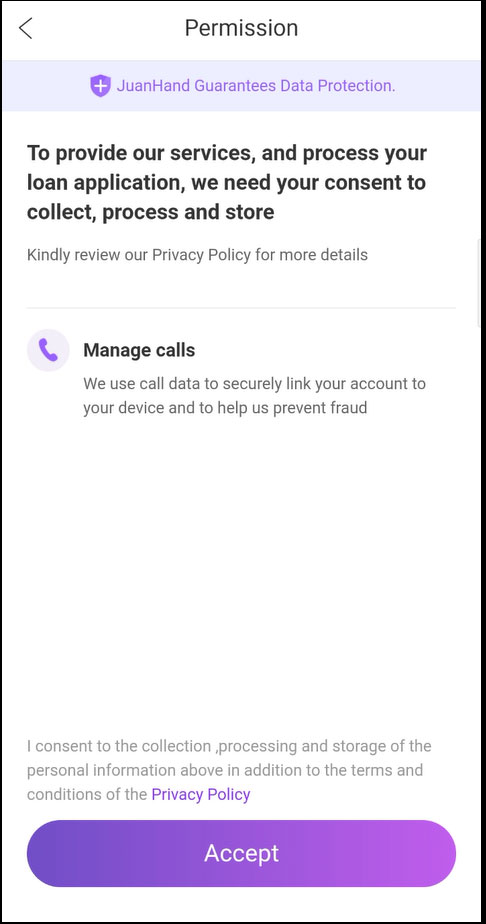

3.) Grant permissions needed by the app. These permissions are necessary continue the registration and for the company to prevent frauds.

4.) You will then be asked to provide your personal information, contact information, and work information. You will need to also provide three emergency contacts which can be your relatives or friends.

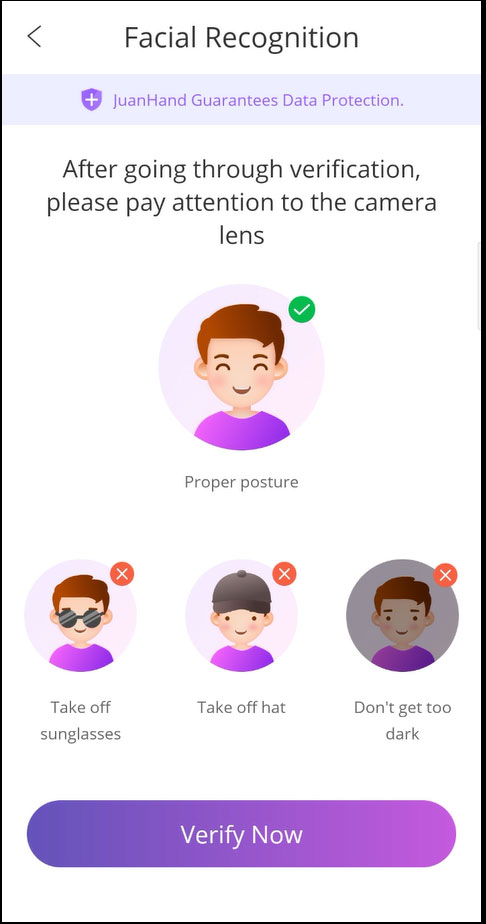

5.) Next, an on-the-spot selfie will be needed by the app. Make sure to follow the instructions to get a clear facial recognition. The person taking the selfie must match the ID to be provided later.

6.) The app will then ask that you to provide a valid ID. Make sure that the ID you’ll be using is in the options. JuanHand can give you a higher credit if you select one of their recommended ID’s. The app will guide you in taking a picture of the ID.

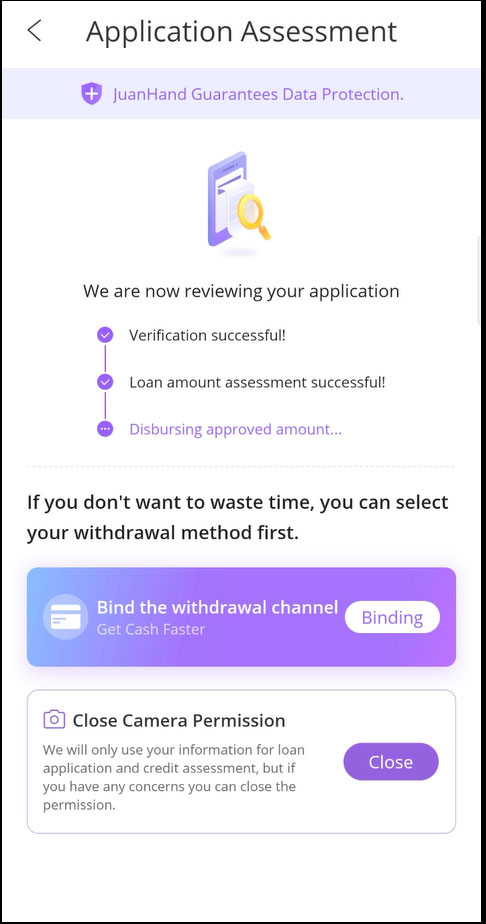

7.) Once all these information are provided, the app will analyze your information and asses your application. It will decide how much you can initially borrow on your first time. This will only take a few minutes.

II. View your loan offer in the JuanHand cash app and claim your cash

After the successful assessment of your application, you won’t be able to borrow a big amount right away. JuanHand will offer you a small loan on your first time. But when you pay your loans on time, your offer will significantly grow bigger each time as it creates trust. You can also get a higher credit limit if you provide the other optional things that JuanHand can ask for, such as your credit card information or PRC ID.

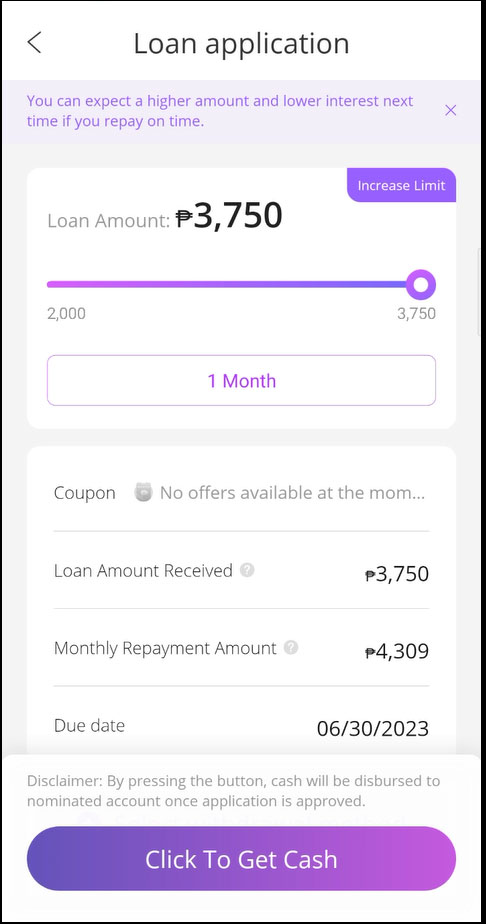

I was initially offered PHP3,750 on my first loan. Here are the steps to cash out your first loan offer:

1.) In the JuanHand cash app, click the Borrow Now button. Choose the amount of money you’d like to borrow by adjusting the sliding bar to your preferred amount. You may also choose to borrow less than your initial offer if that suits you. Then, select the duration of payment. Note that you may only have 1 month as an option in your first loan but later on will have more months for flexible payments.

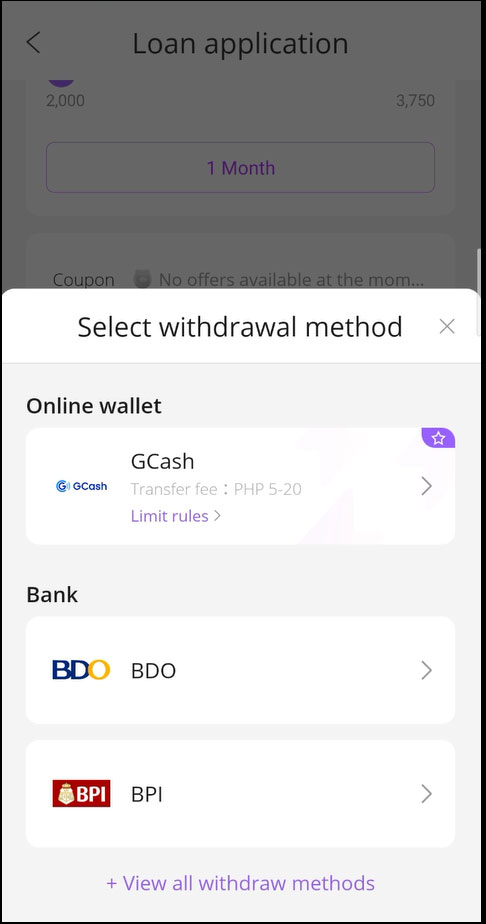

2.) Click the Select Withdrawal Method button to select how you’ll receive the cash. You can receive via your e-wallet like GCash or through your bank account. Once done providing your e-wallet or bank account details, click the Click To Get Cash button.

3.) That’s it! in less than a minute, you’ll be receiving a notification from the app that the cash has been successfully disbursed into your account. When I chose the e-wallet option, I received the full loaned amount. I was not charged yet for any fees. Perhaps the processing fee or transfer fee will be added on your payment amount.

Why do I like this loan app than the others?

Fast and Convenient Application Process:

One of the most impressive aspects of the JuanHand Cash Loan App was its incredibly quick and user-friendly application process. After downloading the app from the app store, I was guided through the registration and verification process seamlessly. It required basic personal information and documentation, ensuring my data’s security while making the application process hassle-free.

Low Processing Fees:

One of the most significant advantages of using the JuanHand Cash Loan App is its transparent approach to fees. Unlike some other lending platforms that hide processing fees, JuanHand has low processing fees that is not deducted from the loaned amount but rather is added on top of the amount to be paid. This gives me peace of mind, knowing that the amount I was borrowing would be the exact amount I’d receive.

Instant Approval and Disbursement:

Once I completed the application process, the magic happened. Within minutes, I received approval for the loan, and the amount was swiftly credited to my bank account. The lightning-fast speed of approval and disbursement amazed me, and it made all the difference in my urgent situation. The JuanHand Cash Loan App lived up to its promise of being a reliable and quick financial solution.

Great Customer Support:

The app’s customer support team was always available to address any queries or concerns promptly. Whether it was about the loan process, repayment, or general assistance, their support was consistently friendly and efficient.

Will I recommend JuanHand?

I highly recommend the JuanHand Cash Loan App to anyone looking for instant financial assistance without the burden of high processing fees. However, as with any financial product, I urge users to borrow responsibly and make informed decisions regarding their finances.

Also, please note that this article is based on my personal experience and the information available up to August 8, 2023. The app’s features and policies may change over time, so it’s essential to check the latest terms and conditions before using any financial service. Always borrow responsibly and consider your financial situation before taking any loans.