Every now and then some of us need to borrow a small amount of money. It could be for an emergency, an added expense, or just to make our budgets stretch until the next salary day. It could be embarrassing to borrow from friends and family, or it could be difficult to get approved for a minor personal loan through a bank. Good thing there are legitimate companies now that offer simple quick loans for small amounts with flexible terms. One good lending company I tried is Tala.

Tala is a global financial company that offers accessible digital financial services, including financial lending. Anybody through the Tala App can borrow money for up to PHP25,000 quickly and efficiently regardless of your credit history. This is very welcoming to Filipinos especially those who just need a micro loan for their small business.

How to get a quick loan from the Tala App?

I. Registration and loan application

Easily register to jumpstart the process of your application. Here are the steps:

1.) First you will need to download the Tala App on your phone. You will need to prepare one valid ID as proof of your identity. You can prepare any of these ID’s:

- UMID (Unified Multi-purpose ID)

- Driver’s License

- Passport

- Voter’s ID (Digitized, with QR code)

- Postal ID

- Social Security System (SSS) ID

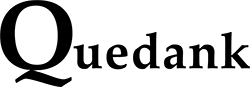

- Philsys ID

2.) Next is you will need to register an account through the Tala App. Create a PIN password and provide your basic information honestly. Once done, you will be prompted to provide a front and back picture of your chosen valid ID, including a selfie with it. This registration serves as your loan application.

3.) When done with registration and submission of ID pictures, you will be notified that your loan application is under review. This may take 24 hours and you will be notified via SMS text message once your approved for a quick loan. You can also check directly in the app if you’ve been approved.

II. View your loan offer in the Tala app and claim your cash

After the approval of your application, you won’t be able to borrow a big amount right away. Tala will offer you a small loan on your first time. But when you pay your loans on time, your offer will significantly grow bigger each time as it creates trust.

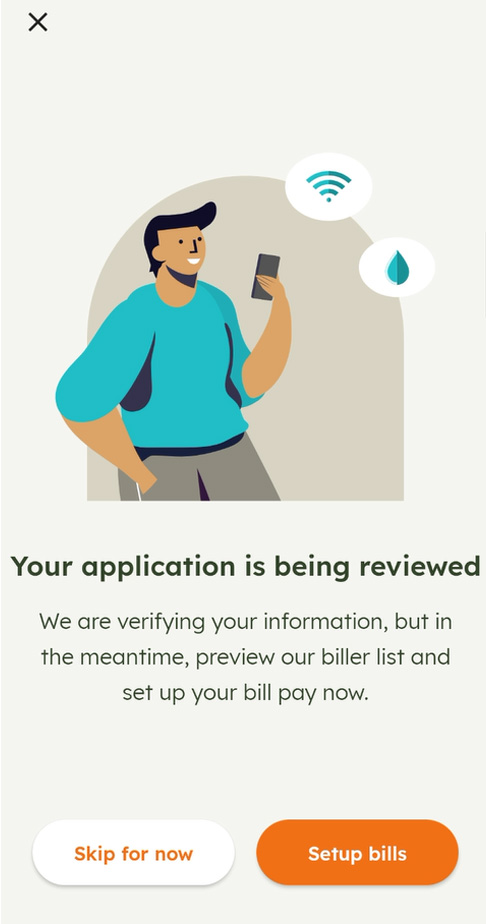

I was initially offered PHP2,000 on my first loan. Here are the steps to cash out your first loan offer:

1.) Login to your Tala app and click the View Loan Offer button.

Note: you don’t have to necessarily need to send more information to Tala’s partner bank (as seen on the screenshot above) to make your first loan. But you will need to do so in order to unlock some features like being able to save and send money using your Tala account, or perhaps to get a higher loan offer.

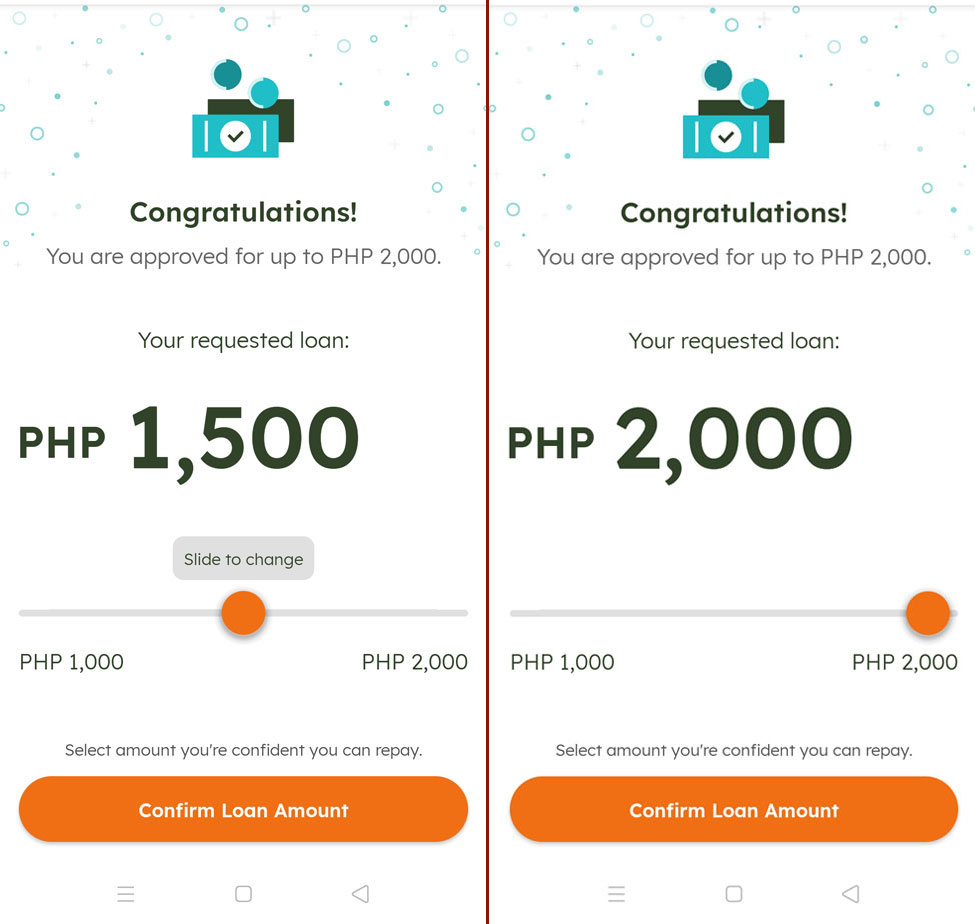

2.) Choose the amount of money you’d like to borrow by adjusting the sliding bar to your preferred amount. You may also choose to borrow less than your initial offer if that suits you.

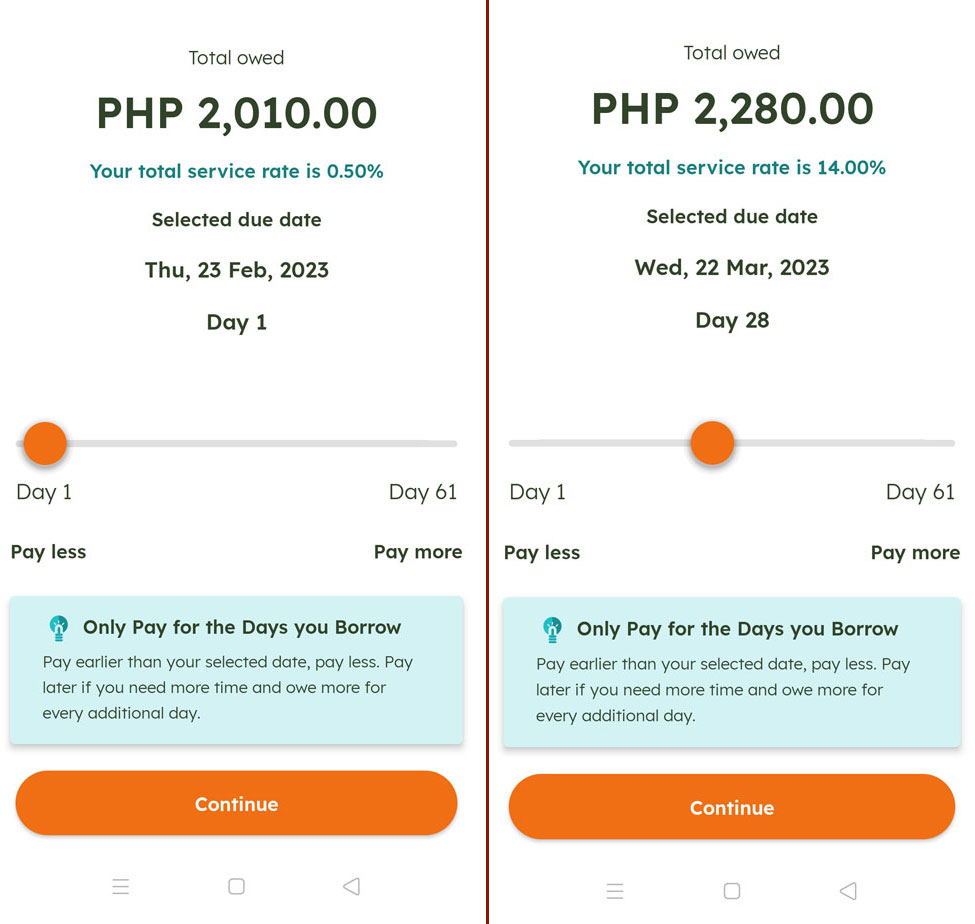

3.) Tala offers flexible terms. Choose your desired time frame for when to pay for your loan. Select your preferred due date by adjusting the sliding bar to the date your comfortable with. The longer the due date is, the higher the interest will be. But you can still pay less interest if you’re able to pay earlier than your chosen due date.

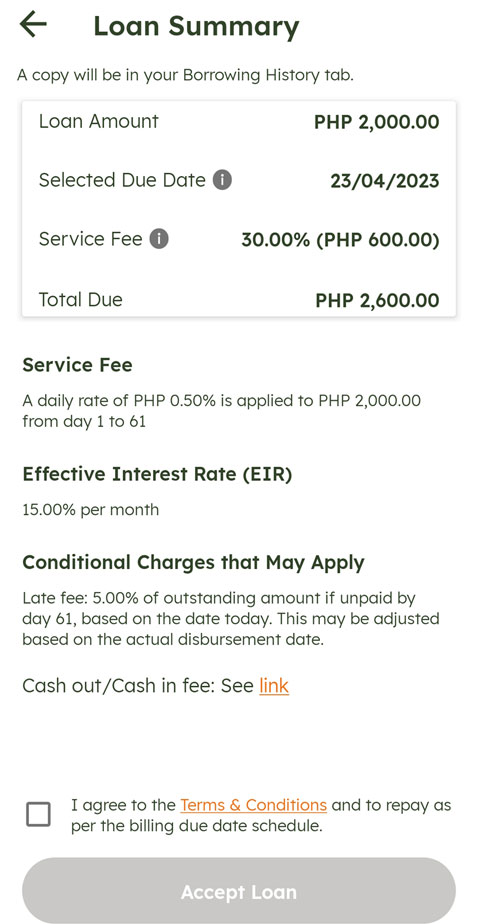

4.) Review your loan summary. Look for the Total Due on the summary and see if that’s an amount your comfortable to pay. If not, you can still go back to adjust your loan amount or the range of your due date.

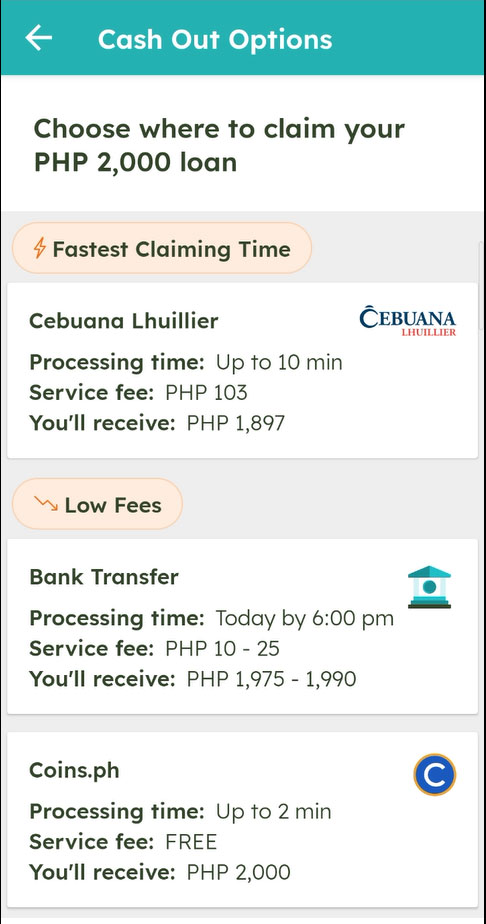

5.) To get your cash, select which financial outlet where the funds will be disbursed. Tala has several cash out options where you can claim you loan. Remember that these outlets from have their own service fees and will be deducted from your borrowed funds when you cash out. Tala will also inform you how much service fee will be deducted by the outlet you’ll choose and how much will remain in your funds.

Some cash out options are faster than others. And some have lower service fees.

Choose from any of these options to cash out:

- Cebuana Lhuillier

- Bank Transfer (select your preferred bank and provide your bank account number)

- Coins.ph

- Palawan Express Pera Padala

- M Lhuillier Kwarta Padala

- LBC Instant Peso Padala

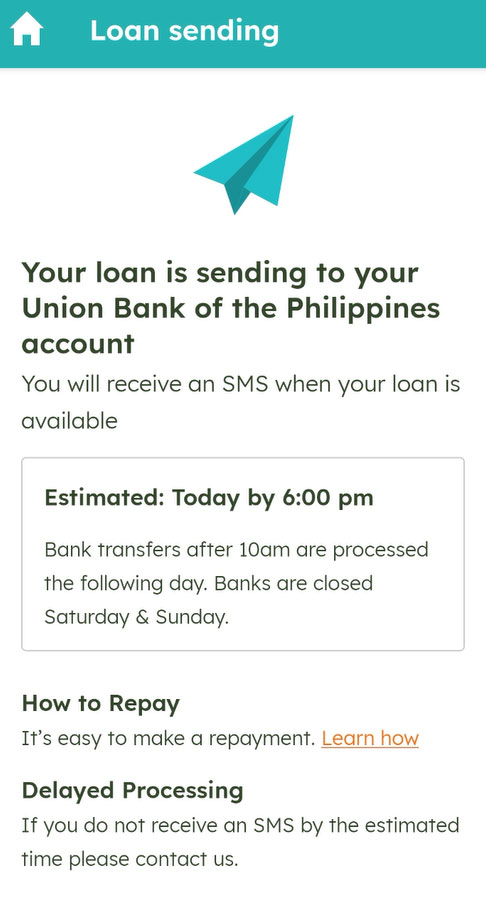

6.) Wait for confirmation. You will be notified by Tala when your funds are available. An SMS text message will be sent to you registered number once everything is set.

Note: If you have chosen Bank Transfer, transactions after 10am will be processed the following banking day. An ETA will also be provided on when to expect the funds to come in.

That’s it! Remember to pay the total due amount on or before your due date to maintain a good standing with Tala. You will be provided with additional instructions on how to pay. You can easily do it through these options when you’re ready:

- 7-Eleven

- GCash

- Cebuana Lhuillier

- M Lhuillier Kwarta Padala

- Coins.ph

- PayMaya