I find it convenient that UnionBank has offered small quick loans to me in the past year. I didn’t really applied for it but it was offered to me via an SMS message. So other than having a UnionBank account, there’s no other way to tell what criteria are needed to be pre-qualified for their Quick Loans program.

How to know if you’re pre-qualified for a UnionBank Quick Loan?

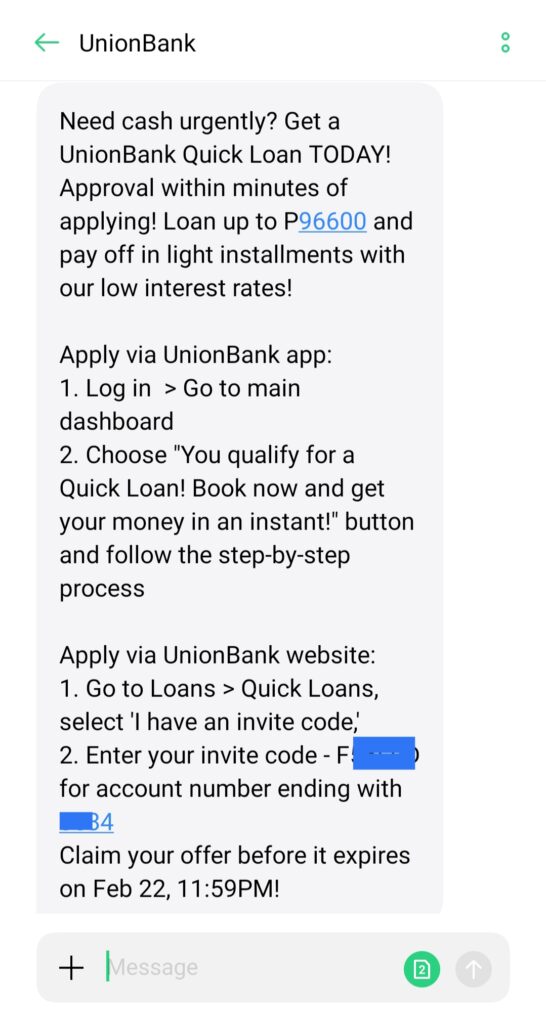

In my case, I was only informed via SMS text message that I was pre-qualified for it. The message also indicated an amount of how much I can borrow and an invitation code. The code was only good for a limited period. Meaning, if you don’t avail the offer, the invite code will expire and you wont be able to avail it until they send you another offer with a new invite code.

It probably helped that I have two savings account with UnionBank and one of them is being used as my salary pay card. Seeing that the accounts always had decent funding could have helped being qualified for the offer.

How much does UnionBank offer for their Quick Loan program?

I was initially offered PHP5000 on my first time. But I was later on offered bigger amounts whenever I availed and paid on time. Perhaps the small initial loan is to check if you’d be able to comply with the terms and to see if you could be in good standing with them.

How to avail UnionBank’s Quick Loan?

If you receive their offer via SMS, you can follow the instructions indicated in the message. There will be a unique invite code and your account number that will be used in the application.

You’ll need to go to the UnionBank website:

- Go to Loans > Quick Loans, select “I Have an invite code.”

- Enter the invite code you’ve received and the account number the loan is offered to.

- You will be asked to provide your information which you’ll need to give honestly.

- For bigger offers, you will be asked how much will you be borrowing, if you will only take a portion of the offer or if you will take the full amount. For initial offers, this option might not be available.

- Choose your due date, how many months will you be paying in installment until completion. For initial offers, this option might not be available.

That’s it. Once done with the submission, you will be approved within minutes. The funds will show immediately in your account.

Take note that they do charge a service fee, which will be deducted from the loaned funds you will be receiving.

Also, if you already have installed the UnionBank app in your phone, you don’t need to go to the website to process it. An additional Quick Loan button will appear in your app. Just click that and follow through the in-app instructions.

How to pay the loan?

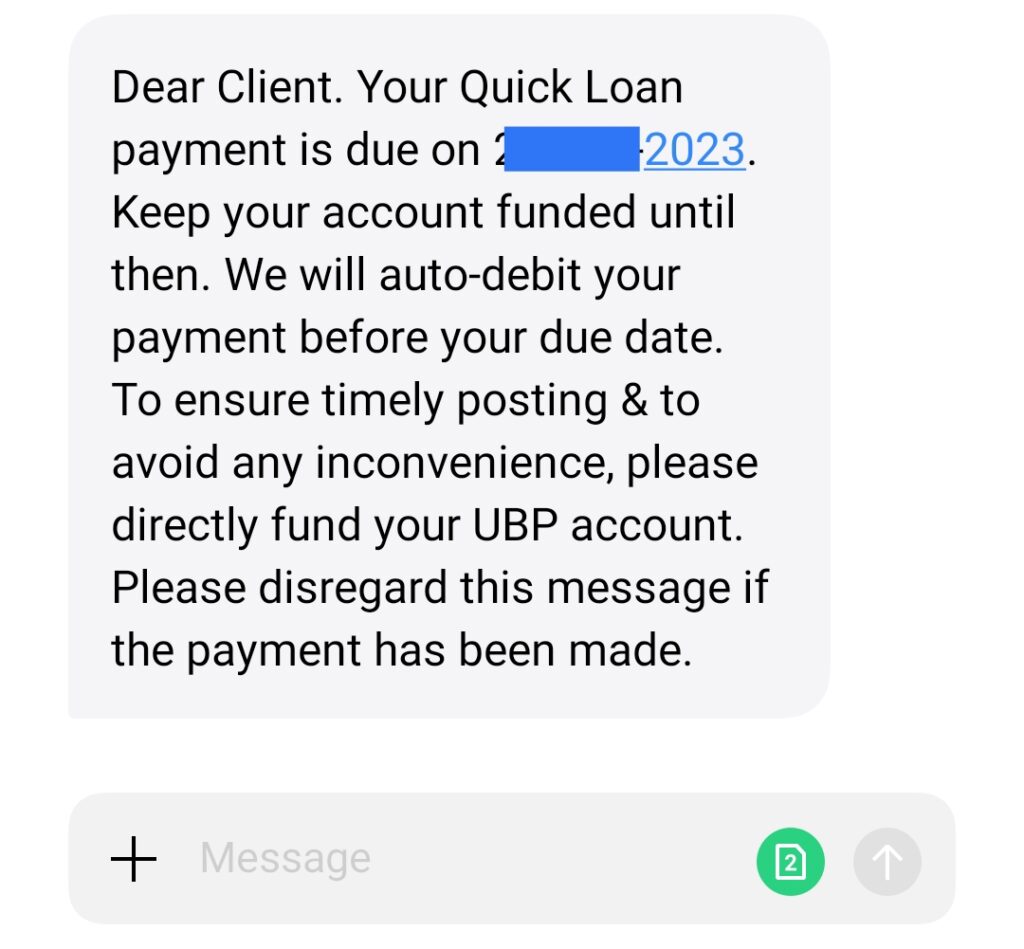

You just need to make sure that you have enough funds available in your account on the due date. It will be automatically deducted from your account as your payment.

You will be notified in time to remind you about your due date.

In my experience, if the funds in your account is not enough, whatever is in there will be deducted and you can pay the remaining balance later but with penalty fees. A representative from the bank will call you to remind and give instructions on how to pay the remainder. I paid my remaining balance through GCash.

How often do they give these Quick Loan offers?

Only one loan at a time is offered. They would give me a new offer as long as my recent loan has been completely paid. Of course a new invite code has to be given first, which that would be under UnionBank’s discretion if you’re qualified for a new one.